Description of non federal direct deposit enrollment request form Show

Print Reset Non-Federal Direct Deposit Enrollment Request Form Authorization agreement for automatic deposits ACH credits Directions for Customer Use Ensure entire form is complete then sign and date Use the ABA routing number from the state where your account was opened Ensure appropriate Employer / Company address is used when mailing completed form. Employer/Company should review this form for completeness and... Fill & Sign Online, Print, Email, Fax, or Download

Direct Deposit Request Form Bank Of America is not the form you're looking for? Search for another form here.   Сomplete the non federal direct deposit for freeIf you believe that this page should be taken down, please follow our DMCA take down process here. Related Catalogs Download a Bank of America Direct Deposit Form, also known as a Non-Federal Direct Deposit Enrollment Request Form. This is an authorization form, for Bank of America, to allow an employer to pay employees with direct deposits or ACH credits to be placed into a Bank of America customer account. This is a process that benefits both the employer and employee by, bypassing a paper check and placing funds owed by the employer directly into the employee account electronically. How To WriteStep 1 – Section 2 – Employer Information – Complete the following Employee information to implement direct deposit services:

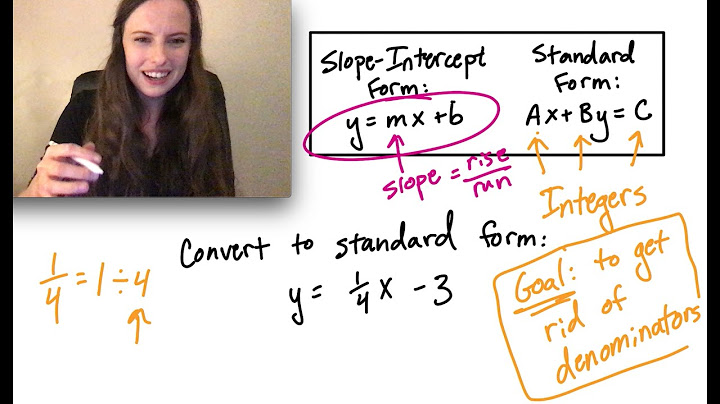

Step 2 – Section 3 – Employee Account Information – Read the paragraph prior to completing account information:

If you would like payments split beyond one account, simply complete the other(s) and specify amounts. Step 3 – Section 4 – Signature and Account holder’s information – Read this paragraph prior to providing signature and other information:

PreviewHow to Video

[fbcomments]

bombuscreative / Getty Images/iStockphoto Direct deposit is a convenient way to receive money from your employer or the government. If you’re a Bank of America customer, you have another reason to consider setting up a direct deposit: It’s a way to avoid monthly maintenance fees on select accounts. Keep reading to learn more about how to sign up for Bank of America direct deposit and how it works. What Is Direct Deposit?Direct deposit is simply the electronic transfer of funds straight into your Bank of America, Member FDIC, bank account from the entity that is paying you, which might be your employer or a government agency. Direct deposit is faster and less expensive than issuing paper checks. How To Set Up Direct Deposit With Bank of AmericaThere are multiple ways to set up a Bank of America direct deposit. No matter which method you choose, you need to provide information about yourself and your account.

How To Set Up a Direct Deposit From an EmployerTo set up a direct deposit from your employer, follow these steps:

How To Set Up a Direct Deposit From the U.S. TreasuryFor benefits being paid by the federal government, such as Social Security and Veterans Affairs payments, you have three options. The first is to complete the process online:

You also can call the U.S. Treasury or schedule an appointment at a local Bank of America branch during regular business hours. Should You Utilize a Bank of America Direct Deposit Form?If you are a Bank of America customer, it makes sense to set up a direct deposit for recurring payments. Not only is it a convenient way to receive money, but it can also bring you significant savings. For example, Bank of America Advantage Plus Banking® checking account holders can waive the $12 monthly maintenance fee when they have at least one qualifying direct deposit of $250 or more made to their accounts. That’s a savings of $144 per year. Bank of America Direct Deposit Form Frequently Asked QuestionsOnce you begin the process of setting up direct deposit at Bank of America, you'll probably have some questions. Here are some common ones:

This article has been updated with additional reporting since its original publication. Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article. Information is accurate as of Sept. 27, 2022. Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article. Karen Doyle is a personal finance writer with over 20 years’ experience writing about investments, money management and financial planning. Her work has appeared on numerous news and finance websites including GOBankingRates, Yahoo! Finance, MSN, USA Today, CNBC, Equifax.com, and more. Learn More What is a non federal direct deposit enrollment request form?What is the Non-federal Direct Deposit Enrollment Request Form Tax Return? Bank of America Direct Deposit Form is an official non-federal form that allows an employer to gather all the needed information to start making payments directly to an account of an employee who submitted the document.

Where can I get my direct deposit form Bank of America?You can find this form on Bank of America's website. Alternatively, you can sign in to Online Banking and download a preprinted Bank of America direct deposit form. This form takes the place of a Bank of America voided check. Give the direct deposit form to your employer for processing.

Does Bank of America give direct deposit forms?Enroll in Online Banking today or choose your preferred language from the following list and download a blank direct deposit form (PDFs, require Adobe Reader layer). In order to complete the direct deposit form, you'll need to know: Your Bank of America account and ABA routing numbers.

What is a direct deposit enrollment form?What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 en.idkuu.com Inc.